| Apr 28, 2025

Creating a Financial Education and Wellness Brand That Helps Students Master Their Money: A Case Study

Managing money is one of the biggest stressors facing college students today — yet most financial education feels outdated, overwhelming, or just plain boring. University of Pittsburgh (Pitt) Office of Admissions & Financial Aid had launched a new Financial Wellness Program to provide financial education to empower college students with the knowledge and tools needed to make informed financial decisions during college and after graduation. Pitt approached us to help create a financial wellness brand to build awareness of the program amongst the students and to boost student participation.

We knew we needed a fresh, relatable approach. Our goal wasn’t just to deliver information. It was to build trust, spark action, and make financial confidence feel achievable — even for students who might have never budgeted before.

Enjoy the creative first and then read about our thinking behind it.

Brand Line

We developed and presented several brand line ideas. Client loved and selected “Know Money”.

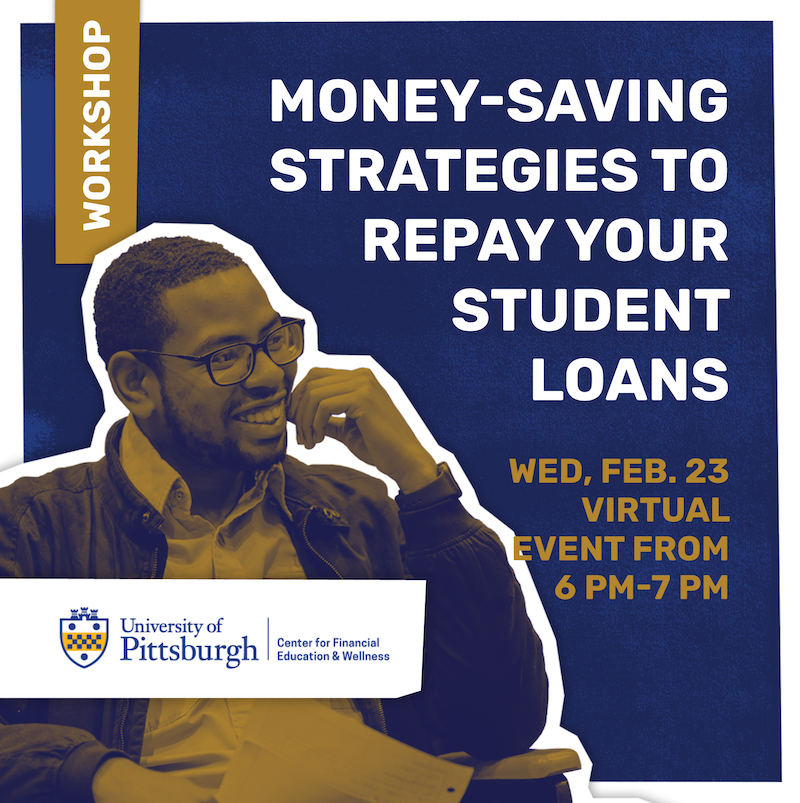

Social Media Tiles

Since events and event attendance are the cornerstone of student outreach, we developed a creative style that would appeal to Gen-Z and rendered several social media promotional assets for various events.

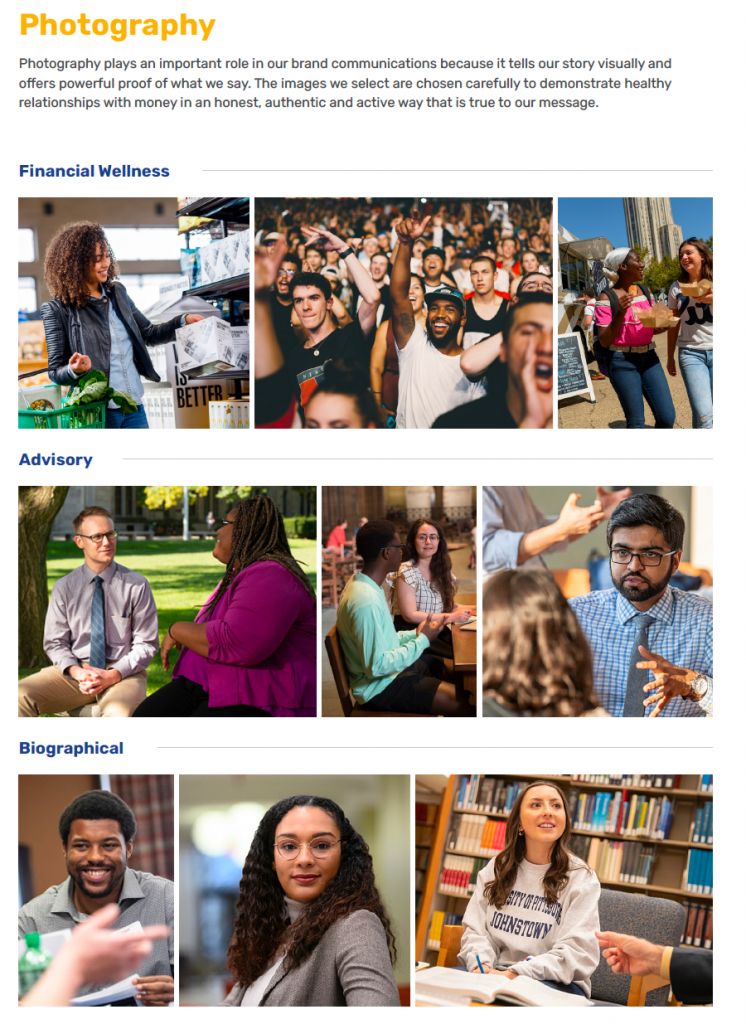

Unique photography style

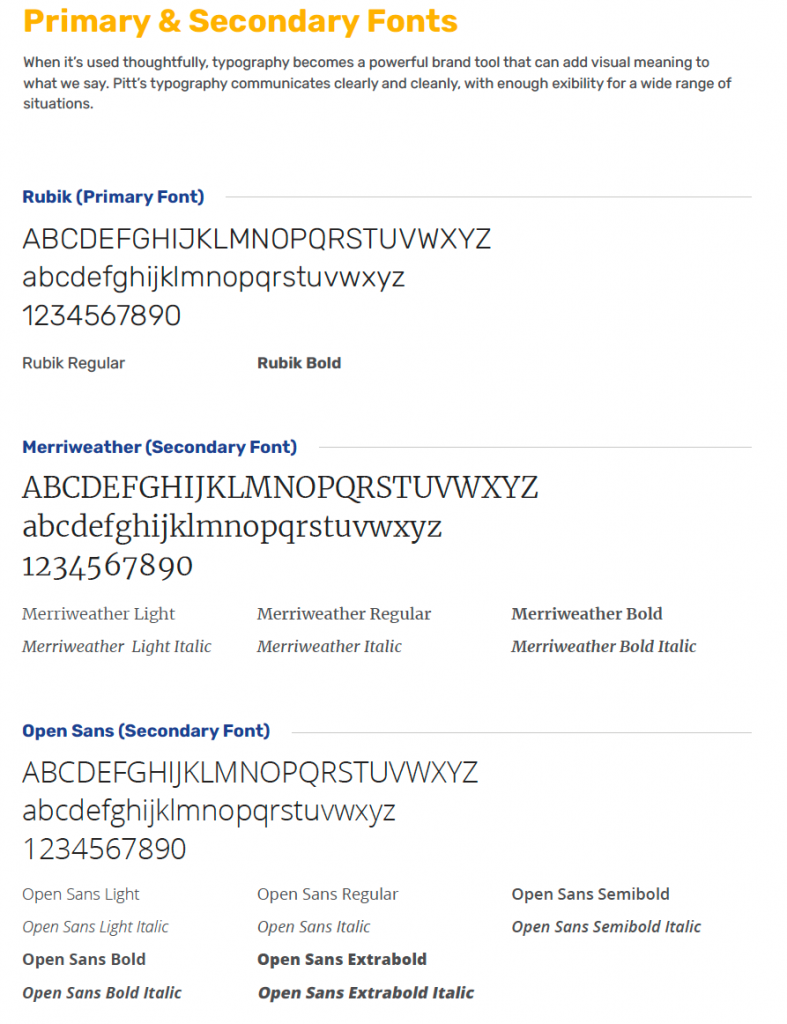

Identity System

We developed a logo, color palette and font style guide that was aligned with Pitt’s brand standards.

Here are a few glimpses of our brand development process, the insights we uncovered, and the strategy we built.

Discovery – Understanding Student Audiences

To build a brand that truly resonates with college students, we started by listening to students carefully. Through a mix of surveys and interviews, we uncovered some key insights that shaped our approach.

Here are a few key learnings:

- Students had a mixed reaction to their old name “Financial Wellness Program”. The phrase “Financial Wellness”. It was not immediately relevant, and it felt like a hollow buzzword. “Program” felt like it was a pre-packaged & finite, and not one-on-one activity that required a longer time commitment. This led us to propose several new names and “Center for Financial Education & Wellness” was selected.

- Students who will benefit most from the Center for Financial Education & Wellness are at an inflection point in their lives – moving from financial dependence toward independence. Even though most have taken on significant debt, they aren’t accustomed to handling money and admit they don’t have a plan.

- To varying degrees, students lack experience and confidence in managing their own affairs. For some, their worries are only made worse by not having good financial role models at home. Overall, students need help with issues involving borrowing, budgeting, and building wealth long term. They also need help understanding the vocabulary of money and personal finance.

- Students fall into two groups: Those who have resources and those who don’t.

- While students who lack resources are far from being alone with their money worries, they see their problems as being deeply personal and private. They feel isolated and somewhat embarrassed. Some wait until they’re in serious trouble before they look for help. Others will poke around doing unguided searches on the internet looking for answers. These are students whose parents can’t be depended upon for financial advice, who lack fundamental financial know-how and often have immediate, pressing problems with managing their loans and budgeting.

- Other students are better resourced – they have parents, siblings, and mentors they can lean on for advice. They’re also more familiar with online resources that can help them better manage their money. While this group is more confident, they’re also inexperienced. They’re anxious about the future, and what will happen as they enter the workforce. They’re looking for student loan repayment strategies, budgeting to live within their means, establishing credit, investing, and saving for retirement.

- Regardless of which group a person may fall into, the most important thing to know about students is that they hold Pitt in very high regard. They trust Pitt as educators. Their trust is the lifeblood of our brand. It is what distinguishes the help we wold offer from all the other financial information students can find anywhere else.

- From both an operations and communications standpoint, our work should always build upon the high regard students have for Pitt and the trust they place in Pitt and the Center.

- Students want short, clear action steps, especially from peer-counselors and financial mentors not academic lectures.

Brand Strategy – Positioning for Empowerment

Based on what we learned, we developed a brand strategy focused on three values: wellness, knowledge and social equity.

We are an authority who is thoughtful, intelligent and friendly. We respect the intelligence of our readers and listeners by communicating simply and conversationally. We don’t use the lingo of the moment to appear young, and we don’t speak in ways that are flip or overly casual. The students have important financial concerns, and the way we respond to them is always mindful of this.

Key deliverables included:

- Brand Name: The Center for Financial Education & Wellness

- Brand Position: Pitt’s student resource for personal finance education

- Our Promise: Help students find their path to financial security.

- Brand voice: Thoughtful, intelligent and friendly.

- Functional Value: Control over personal finances. The ability to make good financial decisions. A doable financial plan.

- Emotional Rewards: Confidence, inner peace and pride.

- Messaging for Students: Pitt Center for Financial Education & Wellness offers free, personal finance education for all students. Led by resident experts, Joel Philistin and Janet McLaughlin, our team conducts small group workshops, coaches you one-on-one, and connects you with helpful educational resources. We’re here to take the mystery out of complex financial terms and make you smarter about borrowing, budgeting and building wealth – life skills that will serve you well now, and always. Be prepared for tomorrow. Make an appointment today.

- Messaging for Pitt Faculty, Staff & Administrators: Pitt Center for Financial Education & Wellness offers free, personal finance education for all students, and is led by resident experts, Joel Philistin and Janet McLaughlin. Their team takes the mystery out of complex financial terms and makes students smarter about borrowing, budgeting and building wealth – life skills they can use now, and always. Know somebody who needs help managing their personal finances? Connect them with the Center today.

- Communicating the Value of our Peer-to-Peer Mentors to Students: While it’s easier to talk about personal finances with someone who shares life experiences like your own, our peer mentors offer more than just a sympathetic ear. They’ll give you good advice that comes from thoughtful, thorough training.

- Communicating the Value of Pitt’s Expert Network to Students: Pitt is a powerful economic engine driving the Pittsburgh region’s prosperity for over two centuries. We routinely tap into our extensive network of friends, partners and alumni who are eager to share their financial wisdom with us – and most importantly, with you.

- Communicating the Mutual Nature of our Commitment to Students: You have a lot invested in us, and we don’t take our obligation to see you succeed lightly. Pitt is your partner. After all, our reputation rests on the future that students like you will build.

That’s the back story. If you’re working on branding for Gen Z audiences — or thinking about tackling financial wellness in a fresh way — we’d love to collaborate with you. Please contact us.