| Aug 10, 2019

Amazon Advertising is Changing the Battle for Consumer Attention

Until recently, the battle for consumer attention on digital devices and platforms was led by Google, Bing, Facebook, Instagram, LinkedIn and Twitter – and to a lesser extent by Pinterest and Snapchat. The entry of Amazon dramatically changes the dynamic of online advertising. It is now the third largest digital advertising platform in the US.

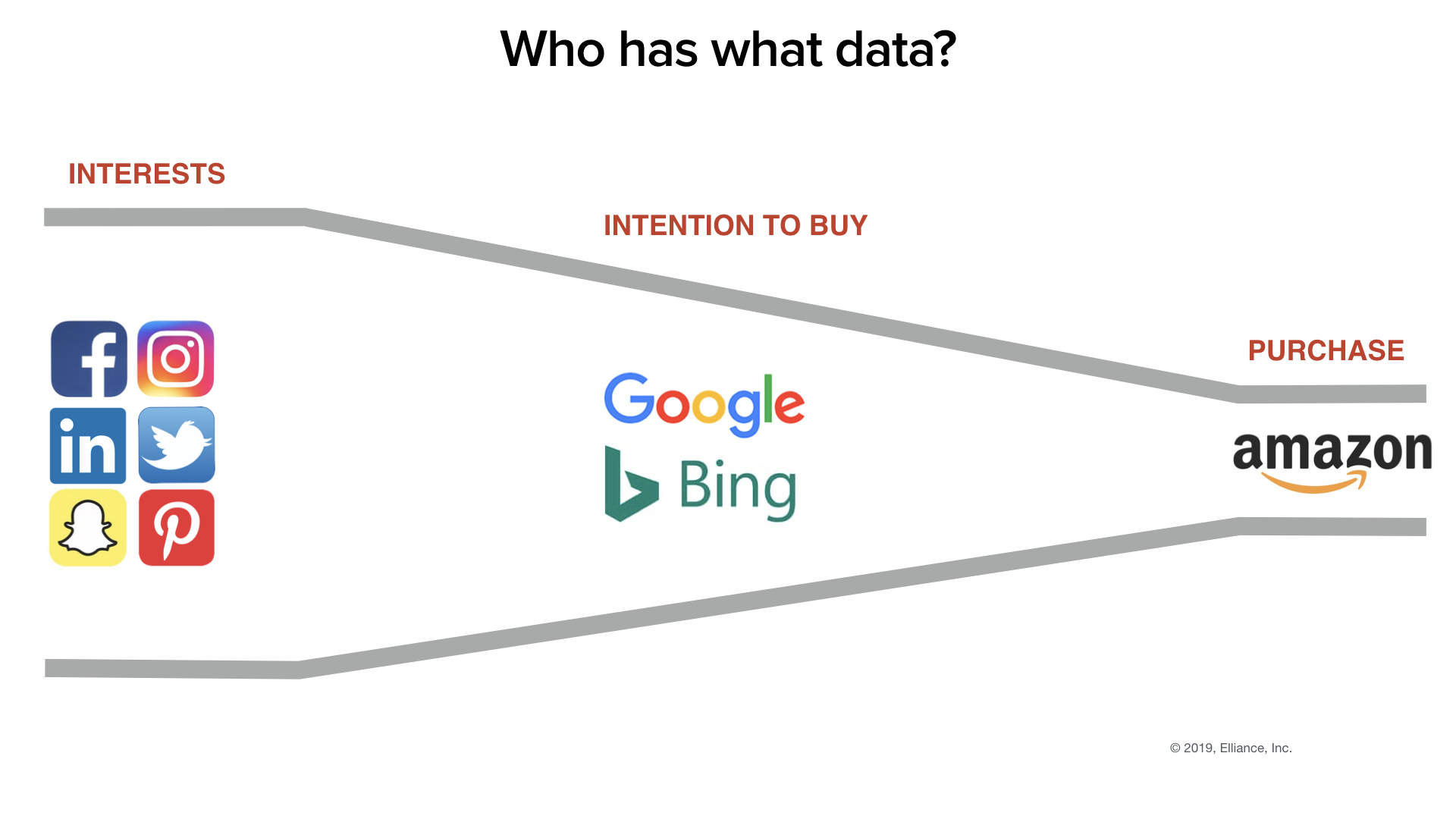

To put things in perspective, here is how these platforms are situated in the demand funnel.

In a nutshell, social media platforms know buyer’s interests and let them discover new products/services; Google and Bing have the intelligence about the buyer’s intention to purchase something; and Amazon has data about what products buyers are purchasing.

Each player now offers its own advertising service, with e-commerce product companies favoring Amazon Advertising, and all other companies using a combination of Google, Bing and social media advertising platforms.

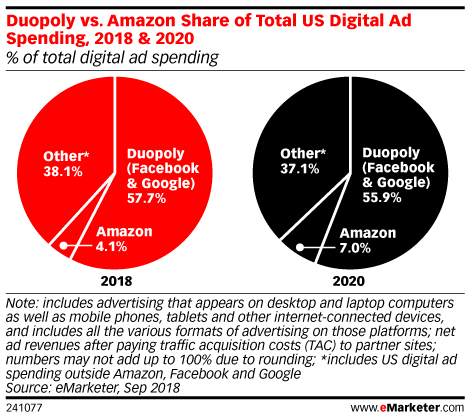

According to eMarketer, Amazon advertising is still a distant third behind Google (37%) and Facebook (20%) in US digital ad spending, but it already accounts for 4% of US digital ad spending, and is expected to grow to 7% by the year 2020. Amazon’s recent simplification of its confusing ad offerings will further accelerate the growth of its market share. It now offers both on-Amazon and off-Amazon advertising options in both Pay-per-Click and Pay-per-View modes.

To combat Amazon’s encroachment into its ad revenue streams, Google for Retail has already responded by launching Google Shopping Actions to contain buyers within the Google platform instead of sending buyers to e-commerce platforms.

Life is about to get far more complex for e-commerce retailers.

If you are seeking a paid advertising agency, consider partnering with us.